Uncovering local market secrets is a powerful strategy for traders seeking "wealth within". By understanding regional dynamics shaped by culture, economy, and politics, traders gain competitive advantages. This approach minimizes risks, navigates regulations, and fosters stronger market connections. Key aspects include exploring customs, seasonal trends, building networks of trusted sources, and leveraging advanced digital tools for data-driven insights. Ultimately, this local knowledge unlocks new opportunities for wealth generation.

Enhance your trade strategies and unlock hidden opportunities with local insights. In today’s global market, understanding the intricate dynamics of foreign territories is key to success. This article guides you through a strategic approach to mastering trade entry and exit timing.

From deciphering cultural nuances to leveraging seasonal trends, each tactic offers a unique advantage. Discover how building trustworthy networks and employing data-driven tools can provide an edge in navigating complex landscapes. Uncover the wealth within by making informed decisions based on local insights.

- Understanding Local Market Dynamics for Better Timing

- Leveraging Cultural Insights for Trade Opportunities

- Exploiting Seasonal Trends to Optimize Exit Strategies

- Building a Network: Who to Trust for Accurate Insights?

- Data-Driven Decisions: Utilizing Advanced Tools for Trade Timing

Understanding Local Market Dynamics for Better Timing

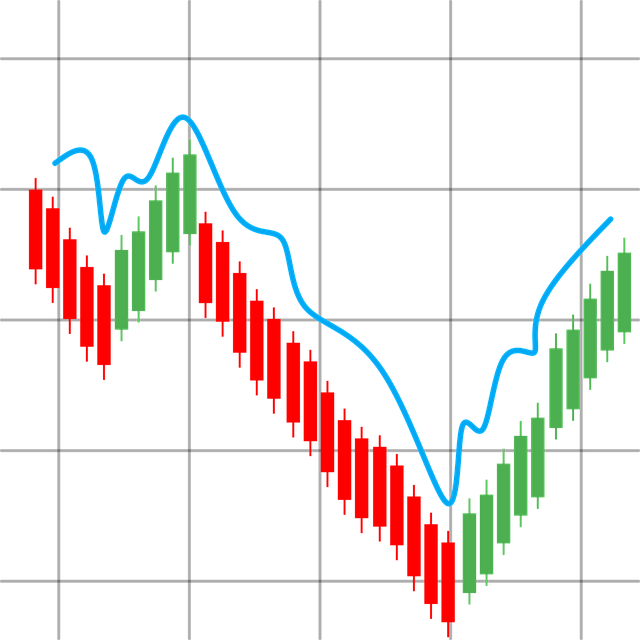

Understanding local market dynamics is key to enhancing trade entry and exit timing, ultimately aiming for wealth within. Market conditions can vary significantly from one region to another, influenced by unique cultural, economic, and political factors. By delving into these local insights, traders can identify emerging trends and shifts in consumer behavior much earlier than their competitors. This foresight enables them to time their market entry or exit strategically, capitalizing on opportunities or minimizing risks.

Local knowledge also helps traders navigate the complex web of regulations, customs, and preferences that may impact trade. Staying attuned to these dynamics ensures compliance and fosters a deeper connection with the target market, potentially opening doors to new wealth-generating avenues.

Leveraging Cultural Insights for Trade Opportunities

Understanding a local culture is like unlocking a treasure map for trade success. By delving into the customs, traditions, and values that shape a market, businesses can spot opportunities missed by outsiders. For instance, certain cultural events or festivals can be lucrative times to launch products, while knowledge of local preferences in food, clothing, or entertainment reveals untapped niches within an industry. This isn’t just about sales; it’s about building relationships and finding the wealth within diverse markets.

Local insights enable businesses to navigate complex social landscapes, ensuring their marketing strategies resonate with consumers. For example, a brand might tailor its messaging to align with regional ethics or modify its packaging design based on cultural aesthetics. This level of adaptation fosters trust and enhances customer loyalty, paving the way for smoother trade entry and exit.

Exploiting Seasonal Trends to Optimize Exit Strategies

Exploiting seasonal trends is a powerful strategy for traders looking to optimize their exit timing and maximize profits. By understanding and anticipating seasonal fluctuations in various markets, traders can time their exits more effectively, potentially leading to significant wealth within. For example, agricultural commodities often experience distinct seasonal patterns, with prices peaking or dropping at specific times of the year due to harvests or changing weather conditions. Traders who stay informed about these trends can plan their exit strategies accordingly, selling at opportune moments to capture gains or locking in profits before potential price corrections.

This seasonal approach isn’t limited to agriculture; it applies across diverse markets. For stocks and equities, certain sectors tend to perform better during specific seasons due to changing consumer behaviors or economic cycles. By keeping an eye on these seasonal shifts, traders can adjust their exit points, ensuring they realize profits when the market is at its peak or mitigate losses before a seasonal downturn. This strategic timing not only enhances overall trading performance but also contributes to building and securing wealth within the market.

Building a Network: Who to Trust for Accurate Insights?

Building a network of trusted sources is paramount in navigating the intricate world of international trade. To enhance trade entry and exit timing, access to accurate and timely insights is wealth within your grasp. Identify local experts, industry peers, and business associations who possess deep knowledge of market trends, regulatory changes, and cultural nuances. These connections can provide insider information on emerging opportunities, potential risks, and the best timing for entering or exiting markets.

When selecting who to trust, verify their reputation and track record. Look for individuals or organizations with a proven history of delivering reliable insights that have led to successful trade ventures. Reputable business journalists, respected academic institutions, and influential industry publications can also be valuable resources, offering analyses and predictions that help make informed decisions about when to enter or exit the market, ultimately maximizing profitability and minimizing risks.

Data-Driven Decisions: Utilizing Advanced Tools for Trade Timing

In today’s digital era, advanced tools are revolutionizing the way businesses approach trade timing, enabling them to make data-driven decisions that can significantly enhance their wealth within. These innovative solutions offer real-time insights into market trends, historical patterns, and geopolitical events, empowering traders with the knowledge to enter or exit markets at the optimal moment. By leveraging machine learning algorithms and sophisticated analytics, these tools predict potential price movements and identify lucrative opportunities, ensuring traders stay ahead of the curve.

Such technologies provide a competitive edge by allowing businesses to navigate the complex global market landscape more effectively. With access to gossamer data threads, including economic indicators, news sentiment analysis, and social media whispers, traders can make informed choices that maximize profits and minimize risks. This level of precision in trade timing is a game-changer, transforming potential losses into wealth within reach for forward-thinking companies.

By harnessing local insights, from cultural understanding to seasonal trends, and leveraging a robust network of trusted sources, traders can significantly enhance their trade entry and exit timing. This data-driven approach, coupled with advanced tools, ensures that market movements are predicted with greater accuracy, allowing for optimized strategies and the potential to unlock substantial wealth within the dynamic global marketplace.